Introduction

Hey there, fellow market enthusiasts! Ever wondered which day of the week brings the most joy to Dow Jones investors? Well, we’ve crunched the numbers for the past 20 years to find out exactly that! Spoiler alert: it’s time to rethink your trading strategy! In this article, we’ll reveal the most positive day for Dow Jones returns and how you can use this information to your advantage.

Data Collection

First things first, we need to gather historical data for the Dow Jones Industrial Average (DJIA). We’ll use Python and a handy financial data library to fetch the data.

Python Script for Data Collection

Let’s get our data ready! Here’s the Python script to download the historical DJIA data:

import pandas as pd

import yfinance as yf

import datetime

# Define the time period

start_date = datetime.datetime.now() - datetime.timedelta(days=20*365)

end_date = datetime.datetime.now()

# Download DJIA data

djia = yf.download('^DJI', start=start_date, end=end_date)

djia.to_csv('djia.csv')This script fetches 20 years of DJIA data and saves it as a CSV file for further analysis.

Analyzing the Most Positive Day for Dow Jones Returns

Now, let’s dive into the analysis to determine which day of the week has historically been the most positive.

Python Script for Analysis of the Most Positive Day for Dow Jones Returns

Here’s the script to analyze the DJIA data:

import pandas as pd

# Load the data

djia = pd.read_csv('djia.csv', parse_dates=['Date'], index_col='Date')

# Add a column for the day of the week

djia['DayOfWeek'] = djia.index.day_name()

# Calculate daily returns

djia['Return'] = djia['Adj Close'].pct_change()

# Group by day of the week and calculate the mean return

mean_returns = djia.groupby('DayOfWeek')['Return'].mean()

# Convert to percentage

mean_returns = mean_returns * 100

# Sort the results

sorted_mean_returns = mean_returns.sort_values(ascending=False)

# Plot the mean returns in percentage

sorted_mean_returns.plot(kind='bar', color='skyblue')

plt.title('Average Daily Returns for DJIA by Weekday (Last 20 Years)')

plt.xlabel('Day of the Week')

plt.ylabel('Average Return (%)')

plt.xticks(rotation=45)

plt.grid(True)

plt.show()

# Display the results

print(sorted_mean_returns)Results for the Most Positive Day for Dow Jones Returns

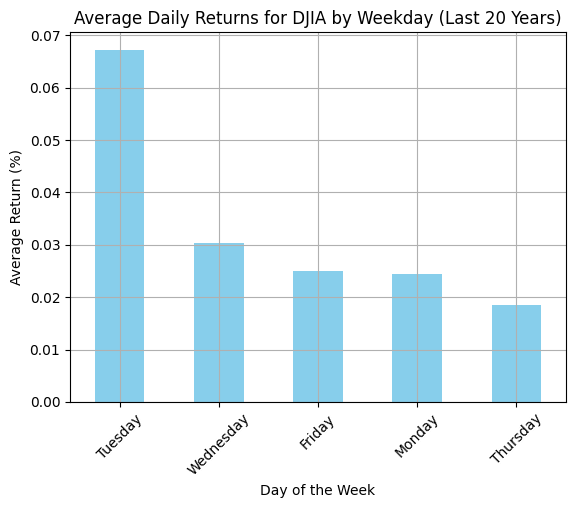

After running the analysis, we get the average returns for each day of the week in percentage terms. Here’s what we found:

As you can see, Tuesday takes the crown with an average return of 0.07%. It’s followed by Wednesday, Friday, Monday, and Thursday in that order. Even though the percentage returns might seem low, remember these are daily returns, and they compound over time!

Strategy: Investing Only on the Most Positive Day for Dow Jones Returns

Now, let’s test a strategy where we only invest on Tuesdays and compare the performance with the overall market.

Python Script for Strategy Analysis on the Most Positive Day for Dow Jones Returns

# Filter data for only Tuesdays

tuesdays = djia[djia['DayOfWeek'] == 'Tuesday']

# Calculate cumulative returns for Tuesdays

tuesdays['CumulativeReturn'] = (1 + tuesdays['Return']).cumprod()

# Calculate cumulative returns for the overall market

djia['CumulativeReturn'] = (1 + djia['Return']).cumprod()

# Plot the cumulative returns

plt.figure(figsize=(10, 6))

plt.plot(djia.index, djia['CumulativeReturn'], label='Overall Market')

plt.plot(tuesdays.index, tuesdays['CumulativeReturn'], label='Tuesdays Only', linestyle='--')

plt.title('Cumulative Returns: Tuesdays Only vs Overall Market (Last 20 Years)')

plt.xlabel('Date')

plt.ylabel('Cumulative Return')

plt.legend()

plt.grid(True)

plt.show()

# Compare final returns

overall_return = djia['CumulativeReturn'].iloc[-1]

tuesday_return = tuesdays['CumulativeReturn'].iloc[-1]

print(f"Overall Market Cumulative Return: {overall_return:.2f}")

print(f"Tuesdays Only Cumulative Return: {tuesday_return:.2f}")

Results

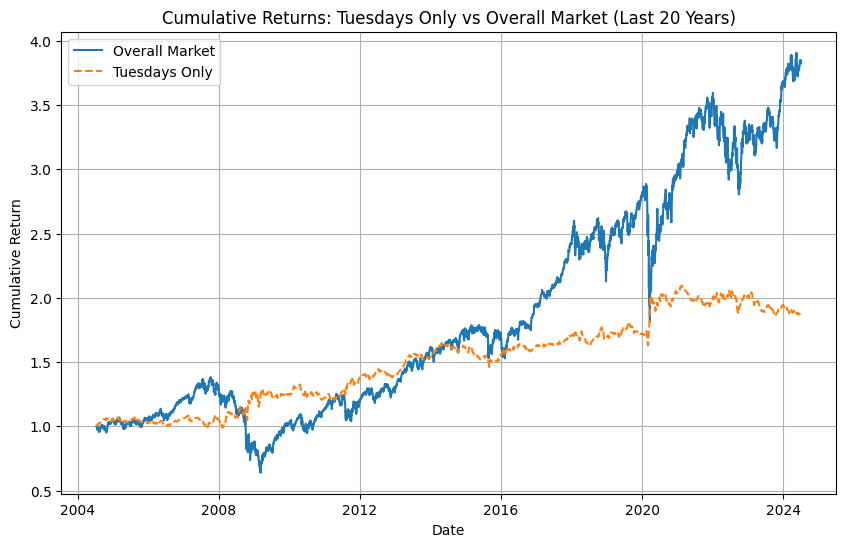

Running this analysis provides a clear picture of how the strategy of investing only on Tuesdays compares with the overall market performance. Check out the cumulative returns below:

The orange dashed line represents the cumulative returns of investing only on Tuesdays, while the blue line represents the overall market. As you can see, the overall market significantly outperforms the “Tuesdays only” strategy.

Implications and Applications

Even though daily returns might seem small, the cumulative effect can be significant. By understanding which days of the week yield the highest returns, investors can refine their strategies for potentially better outcomes. For instance, focusing on Tuesdays, which historically show higher returns, might be an effective strategy, but as our analysis shows, it’s crucial to diversify and not rely on a single day.

Conclusion

Analyzing historical data for the Dow Jones has revealed that Tuesdays are the most positive days for returns. However, implementing a strategy that invests only on Tuesdays does not outperform the overall market. This highlights the importance of a diversified investment approach.

If you enjoyed this article, make sure to check out more at QuantFinanceLab.com. For any queries, drop us a message below or an email at admin@quantfinancelab.com. Happy investing!